Navigating the Role of Guardianship in Estate Planning

Estate planning is about more than just distributing your assets after you’re gone. It’s also about making sure your loved ones are cared for, especially if they’re unable to take care of themselves. This is where guardianship comes into play. When you think about guardianship in estate planning, it might feel a bit overwhelming. No […]

How to Create a Revocable Trust in Carlsbad

Creating a revocable trust is a powerful way to manage your assets and ensure they are distributed according to your wishes. This type of trust offers flexibility and control, allowing you to make changes or revoke the trust entirely during your lifetime. If you are considering setting up a revocable trust in Carlsbad, here is […]

The Importance of Regular Estate Plan Reviews and Updates

Creating an estate plan is a necessity to secure your assets and ensure your wishes are honored. However, it’s equally important to carry out regular estate plan reviews and updates to reflect changes in your life circumstances, financial situation, and legal requirements. Here’s why regular estate plan reviews and updates are essential and how they […]

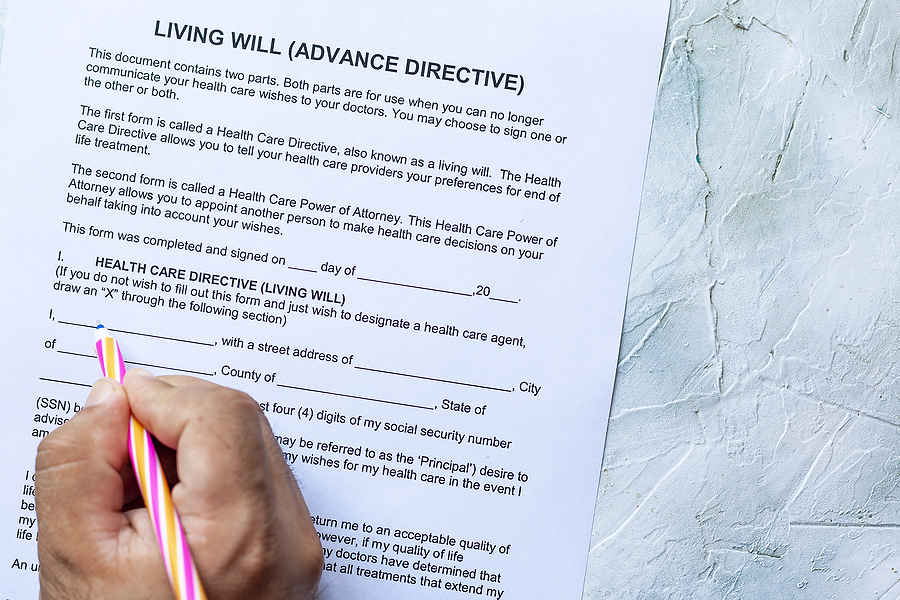

Advanced Healthcare Directives: Planning for Future Healthcare Decisions

None of us likes to think about a situation where we could become incapacitated and unable to make decisions about our own healthcare. However, setting up legal documentation through advanced healthcare directives is the best way to ensure your medical wishes are followed if you can’t make decisions for yourself. With a proper healthcare directive […]

HOW CAN I STRUCTURE MY ESTATE TO PROTECT MY CHILD’S INHERITANCE IN THE EVENT OF A DIVORCE? (video)

For many parents, one of the biggest estate planning concerns is ensuring their children’s inheritances are shielded from potential divorces down the road. You’ve worked hard to build a legacy – the last thing you want is for those assets to become marital property subject to division with an in-law. Fortunately, through strategic estate planning […]

Incorporating Philanthropy in Estate Plan

While the primary motivation is often an altruistic desire to simply give back, there are also numerous potential financial benefits to incorporating philanthropy in estate plan, such as: Tax Advantages Charitable donations can provide significant income, gift, and estate tax deductions. This allows you to redirect a portion of assets you’d otherwise pay in taxes […]

High-Net-Worth Estate Planning in Carlsbad

If you have significant wealth, you understand the importance of protecting those hard-earned assets through careful planning and strategic decision-making. This security extends beyond just your current financial situation – proactive high-net-worth estate planning is critical to safeguard your legacy. As a high-net-worth resident of Carlsbad, California, you face a complex web of federal and […]

Handling Carlsbad’s Complex Estates

Administering an estate can be daunting, especially when it involves complex financial arrangements, multiple beneficiaries, and intricate legal considerations. In Carlsbad, California, where property values have skyrocketed recently, navigating the challenges of complex estates has become increasingly crucial for families and legal professionals alike. Navigating the Challenges Within the California Estate Market One of the […]

Navigating Digital Assets in Your Estate Plan

In today’s digital age, the essence of personal and financial life increasingly resides in the digital realm. From social media accounts and digital photos to cryptocurrencies and electronic banking information, our digital assets form a significant portion of our legacy. As the Law Office of Andrew Fesler in Carlsbad, we recognize the evolving nature of […]

Navigating Estate Tax Implications in Carlsbad

Understanding the intricacies of estate tax implications is a critical aspect of estate planning, especially in Carlsbad, California. The Law Office of Andrew Fesler is dedicated to assisting clients in navigating these often complex legal waters. This blog post will highlight key areas of California law that impact estate taxes and demonstrate how a local […]